I like this stock from both fundamentals and long term chart perspective.

Long term Chart

Usually, the good ideas tend to jumped out at you, and the chart below just jumped out at me.

Odds look high, that the long term investor is going to profit from this type of chart / price action, when combined with excellent fundamentals (but nothing is guaranteed in markets).

Past 10 years business performance

The past 10 year's CAGR looks good, but too good to be true from future perspective?

True 2014 EPS and DPS starts from a low base but even if we look at 9 year CAGR for EPS or DPS, this stock has proven its superior past performance.

Nevertheless, the past doesn't guarantee the future (even if at least this company has proven itself in the past very successfully).

It's a stock where we want to consider own a full position or more near the local bottom.

Note:

1. The current dividend yield is at least 7% per annum. My personal long term assessment of its dividend yield is around 6% per annum, matching/beating EPF. Very nice and good odds to be sustainable (although there may be a short term bump down).

2. It's Net Cash is around RM1.40, when price is RM3.13.

This means net of cash, the business is valued at 3.13 - 1.40 = 1.73.

My long term assessment of its EPS is around 25 sen, factoring in the upcoming bump (even if TTM EPS is around 45 sen).

If you assume EPS=25 sen first, the business is available for sale with a P/E of 6-7 times only.

If you assume TTM EPS of 45 sen, the entire business is available for sale with a P/E of 4 times only.

Either way, whether 4, 5, 6 or 7 times, it is a very undemanding valuation.

The cheapness (Price vs EPS) just jumps out at you.

3. This company has proven to have grown its Net Cash over past 10 years. It's clearly above average, good to excellent quality business over the past 10 years.

4. The Management of this company has proven itself to share its Net Cash with shareholders the past 10 years through generous dividend yield.

5. The stock is available for sale during the corrective wave, i.e. it is not exactly chasing and buying on a breakout, but on pullbacks. There's some fears about declining revenues in the current year, as it's quite a sizeable drop for FYE2023 vs FYE2022. The drop may not be over yet. The question is - is this drop permanent, or do you trust Management to solve this temporary problem over the next 5-10 years? Price looks fair to me for an above average quality business.

6. There's potential for a price gains in the future. It's NTA is currently 2.10, where 2/3rds is Net Cash. It could consider a special dividend one day (a nice bumper gain) and this will also improve its capital efficiency, giving even greater returns to shareholders.

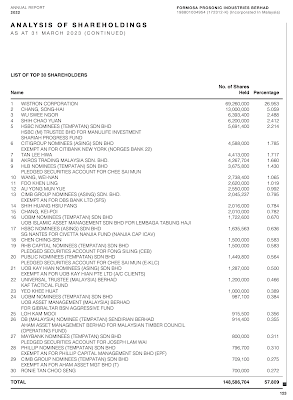

Major Shareholders

Interestingly, the only major shareholder is Wistron owning 26%. The rest are minorities. Top 30 only owned 58%. Feels a bit too low, not quite understand why this would be the case ... (perhaps it due to its ageing Group MD and management?).

Target Position Sizing

At the right price, this stock may deserve an over-weighted position. If my neutral position size is 3% capital (roughly equivalent to 33 long term investing position), then, this stock deserves at least 4% or more (but see below for what I don't like about this stock too). The business fundamentals the past 10 years is good, the management is good (trustworthy enough to share their profits fairly with shareholders, maybe can do a bit more), the chart pattern is good (for long term investors), this one can buy during dips to get to a full size position.

What I don't like about this stock?

Every stock has risks, and sometimes, it's good to play devil's advocate to a stock that you like.

Here are some reasons why I don't think it's wise to own too large a position. If neutral position is 3% of one's portfolio, then, too large a position could be say doubling or 6%.

1. The drop in revenues in FYE2023 vs FYE2022 is quite large. The EPS in 2023 is supported by one-time gains. Next year FYE2024 could show a sizeable shrinking in EPS. Hence, I think 25 sen is a good estimate of its long term EPS, notwitstanding it earned much higher from 37-46 sen the past 3 years. At 25 sen, it is still cheap. However, there's always risk that its future revenue might never make all time high over the next 2-3 years again i.e. it could be a long wait. However, its dividend yield is attractive, but if EPS is too low, future dividends might be cut. Nothing is guaranteed.

2. Related to 1, the business can be regarded as niche, dealing with speaker systems, acoustic products. It's client base is smaller and niche so, there's a higher business/revenue risk than say MAYBANK, due to smaller potential customer base and competition. Whilst it should beat MAYBANK returns over next 5-10 years, it pays to be cautious. Both are good in their own ways.

3. The Group MD, responsible for past success, is a 68 year old Taiwanese who was appointed in 1989... has the alarm bell rung yet? Who will be its successor? Given the large decline in 2023 revenues, does this ageing Group MD still possess the necessary drive to turnaround FYE2023 declining revenue?

4. The stock market cap is only RM800 million - looks like a small cap to me. Small caps are volatile - they can give big wins but they are also riskier and has higher chances of dropping a lot. Hence, not more than 5% of one's portfolio.

5. There's no rule that says that Management can't continue to hoard its Net Cash in the future, especially if the Group MD is getting older. All else equal, older management are typically more conservative.

6. Charts are fickle. Odds are never certain.

7. Over next 10 years, it's almost a certainty that KLSE will face a market crash. Odds are high. In the event of a crash, this stock will crash more than say MAYBANK.

8. The stock is not well covered by analyst. According to i3, there's no coverage. This is both good and bad. The good thing is if one day it gets coverage, the stock is likely to run. If not, we continue to collect its nice dividend yield, well supported by its net cash.

9. Can't find its capital commitments in the last quarterly report. This can raise eyebrows, because R&D seems essential over the long term for future growth, and not too clear from the Quarterly Report on how much it is investing for its future growth over the next 5-10 years.

Hence, for long term wealth accumulation, never be greedy. Overweight from neutral at the right price, say 3.5% to 4%, and that is probably good enough. If there's no opportunity to further add, that's fine too

Investing Strategy & Timing

Overall, I still feel positive about this stock.

Price action feels favorable overall. Since Sep 2021 peak, it has clearly entered a corrective wave phase. Today is March 2024 i.e. it has been consolidating for 2.5 years. Normally, this feels like we are getting close to the bottom, before the next impulse wave up that could last for several years. Nothing is guaranteed of course, but a chart reader plays the odds.

Additionally, I feel the odds of pullback and retesting is more than 50/50. Hence, over the next few months / 1-2 years, we will get a chance to buy cheaper than RM3.13. My immediate target is around 2.85.

I currently own this stock. At 3.13, it is 3.1% of my portfolio, so, I am already slightly overweighted relative to neutral. My average buy price is RM2.63. I first entered on 3 May at RM2.69, continue to buy on the way down at RM2.32 but didn't buy enough, then, buy more on the way up as high as RM2.87 to get to near 3% capital.

And this is good enough to give me a paper gain that is larger than my biggest short term swing trading win. (I trade using a smaller position size, than my long term investing position).

Summary and Conclusion

Some ideas jumped out at you, and this one certainly did a few months ago.

We can never get our entry timing precisely right and we don't need to.

Whilst hindsight is 20/20 and it's easy to feel like I should have loaded up when price fell to 2.32, but this kind of thinking is wrong thinking because nobody knows the future.

Additionally, it's actually not a bad idea, if one's position is not yet full, to be able to buy when price went back up.

I pat myself at the back for forcing myself to get to a full neutral position at least with this stock, even if it means chasing up to 2.87. This is because at 2.87, the valuation is still compelling. That was in early January 2024.

Nevertheless, after nearly 3 months of watching its price action, I suspect over the next few months/ 1 to 2 years, there is good chance to see 2.85, when I plan to load up a little bit more to perhaps up to 3.5% to 4% (depending). It's certainly on my watch list. If it falls below 2.85, that's okay too in the short term, as my game plan is over a much longer time-frame.

Over the next 5-10 years, the odds of making a new high looks better than 50/50 from chart perspective (even if the Group MD is now 68 years old). And the dividend yield is nice 6% or higher per annum and growing. And net Cash growing too.

Hence, decent odds to beat EPF's 5.5% to 6% per annum returns over next 10 years. It's worth a solid position in one's investing portfolio, slightly larger than 3% neutral position IMHO.

As usual, never get greedy, no matter how attractive a stock is. Every stock has risks.

And never be stubborn. Eventually, price action will reveal itself, and when it does something different that what is expected, be mindful to review and reconsider our initial thesis.